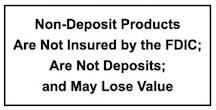

From time to time, we provide links to other websites for the use of our visitors, which have been compiled from internal and external sources. By clicking “Continue” below, you will be opening a new browser window and leaving our website. The products represented via this third-party link are not insured by the FDIC, are not deposits, and may lose value. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

Understanding Your Credit Score and Credit Report

Your credit score and credit report play a crucial role in your financial life. They affect everything from loan approvals to interest rates and even job opportunities. Lenders use your credit score, based on your credit report, to evaluate how likely you are to repay borrowed money. What is a Credit Report? Your credit report is a full list of […]

Creating a Yearly Budget

The new year is a new opportunity to set financial goals, build better spending habits, and take control of your finances. One of the best ways to ensure financial success is by creating a yearly budget. A well-planned yearly budget helps you: Manage your money. Reduce financial stress. Avoid unnecessary debt and control spending. Prepare for major expenses like holiday […]

Using Your Home as Collateral

Your home is one of your most valuable assets and it can be a powerful financial tool. However, using your home’s equity as collateral requires careful consideration. Here’s how to make informed decisions about leveraging your home’s equity. When To Use Your Home as Collateral: Major Home Improvements – Increase your home’s value with renovations that boost resale potential. […]

5 Tips to Avoid Unnecessary Debt During the Holidays

The holidays are fast approaching, and we hope you are anticipating a festive season with friends, family, great food, and maybe even a trip or two. While the holidays are a time for celebration, it can also be a time of financial stress for many. We want to support you with practical tips to avoid the stress of debt not […]

Benefits of a Home Equity Loan

Your home is more than just a place to live; it’s a refuge for family and a gathering place for friends. It’s also a valuable tool to use in achieving your financial goals. Tap into the financial value of your house through a home equity loan. What is a Home Equity Loan? It is a special type of loan that […]