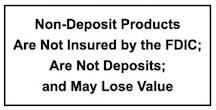

From time to time, we provide links to other websites for the use of our visitors, which have been compiled from internal and external sources. By clicking “Continue” below, you will be opening a new browser window and leaving our website. The products represented via this third-party link are not insured by the FDIC, are not deposits, and may lose value. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

What the Red-Hot Job Market Means for Workers

The COVID-19 pandemic kicked off a severe labor shortage — and quite possibly the most worker-friendly job market in many years. Unpredictable demand shifts exposed pre-existing mismatches between the knowledge and skills of available workers and the tasks for which they are needed. The sheer number of available jobs has also been running far above the number of unemployed job […]

6 Keys to More Successful Investing

A successful investor maximizes gain and minimizes loss. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, here are six basic principles that may help you invest more successfully. Long-term compounding can help your nest egg grow It’s the “rolling snowball” effect. Put simply, compounding […]

Baseball Lessons to Change Up Your Finances

Baseball stadiums are filled with optimists. Fans start each new season with the hope that even if last year ended badly, this year could finally be the year. After all, teams rally mid-season, curses are broken, and even underdogs sometimes make it to the World Series. As Yogi Berra famously put it, “It ain’t over till it’s over.”1 Here are a few lessons […]

Splurge or Save? Making the Most of Your Income Tax Refund

The IRS issued more than 128 million income tax refunds for the 2020 filing season, putting $355.3 billion into the hands of U.S. consumers.1 For most recipients, such a sudden influx of cash prompts an important question: What’s the best way to use the money? Last year, 27% of consumers said they planned to spend their refund on everyday expenses, […]

What Do Federal Rate Increases Mean to You?

The original column appeared in the Tribune-Democrat, written by Eric Renner, CEO and President of 1ST SUMMIT BANK. Click here to see original column. Last week, the Federal Reserve announced that interest rates will likely increase starting in March in an effort to tame the economy’s elevated inflation, which currently remains well above the Fed’s goal. To the average consumer, […]